Attorney Explains APGAR Scores for Birth Injury Evaluation

The Apgar score is a rapid assessment of your baby’s health following birth to determine if intervention is needed. Although not used to diagnose birth

The Apgar score is a rapid assessment of your baby’s health following birth to determine if intervention is needed. Although not used to diagnose birth

Bringing a child into the world should be a joyous occasion, yet for many expectant mothers, especially women of color, the experience is marred by

Nursing Homes Cited for Mistreatment Are Flagged with Special Icon on Government Website In 2019, the Centers for Medicare and Medicaid Service’s (CMS) Five-Star Quality

Report Shows PICU Nurse Distractions from Work Phones Could Be Cause of Medication Errors A late 2019 research study published in JAMA Pediatrics shows that not only are

10 Alzheimer’s or Dementia Warning Signs and Symptoms to Watch For According to the Alzheimer’s Association, a slow decline in memory, thinking, and reasoning skills

7 Ways Medical Malpractice Can Occur That You May Not Be Aware Of According to the National Institutes of Health, about one in 5 Americans

As Elective Surgeries and Outpatient Procedures Resume, Medical Mistakes Will Return Most elective surgeries and non-emergent outpatient visits have been put on hold since mid-March,

Many expectant parents are now facing a new reality and uncertainty about the health care risks related to coronavirus exposure. So far, According to the American

While the purpose of medical devices is to prevent injury and save lives, mistakes continue to be made, and patients become hurt. On Tuesday, March 24,

Researchers Identify Connection Between Treating Depression and Onset of Diabetes Long-term use of antidepressants isn’t breaking news, but now the overuse of the prescription drugs

Doctors May Miss Stroke Signs in Young People According to the American Stroke Association, strokes are on the rise among young people and in the

In 2017, a jury sent ex-neurosurgeon Christopher Duntsch, aka Dr. D and Dr. Death, to life in prison for botched surgeries that resulted in two

Reports Reveal That Walgreens Execs New of Prescription Error Risks Although completely preventable, prescription drug mistakes are some of the most persistent and damaging medical

Illinois Hospitals and Coronavirus Disease Concerns The Centers for Disease Control (CDC) continues to closely monitor an outbreak of respiratory illness caused by a novel

Institute for Safe Medication Practices Releases Top 10 Medication Mistakes of 2019 About one in 5 Americans will experience a medical error in their lifetime. And medication

Changes to An Individuals’ Right of Access to Health Records In January 2018, Georgia-based Ciox Health filed suit against the Department of Health and Human

Government Is Ready to Process Military Malpractice Claims Since 1950, U.S. Military members have been barred from suing the U.S. government for injury or death

Wisconsin Woman Died Soon After Leaving Emergency Room A daycare teacher who was waiting to be seen in a Milwaukee hospital emergency room passed away

How to Find Out If an Illinois Doctor Has A Bad Record Many people feel comfortable choosing a doctor based on friendly feedback provided by

71 Illinois Nursing Homes Named in Third Quarter Violation Report The Illinois Department of Public Health (IDPH) has released its Third Quarter Report of Nursing Home

Breathing Tube Removal Mistakes Can Be Deadly for Hospital Patients During sedation or illness, many hospital patients may require breathing assistance through intubation. The device

Neil Armstrong’s Secret “Hush” Money Settlement as Reported by The New York Times Five years ago, at Mercy Health – Fairfield, a community hospital located

Electronic Health Record Issues Serve Important Purpose in Malpractice Cases An American Journal of Emergency Medicine study found an emergency room doctor will make approximately

Hospital Emergency Rooms Struggle with Dementia Patients Many people who have the beginning signs of dementia or Alzheimer’s Disease may be elderly, frail, and have other underlying

“To know that this happens is our country, that’s unacceptable.” -Sue Sheridan, patient safety advocate, in To Err Is Human The medical malpractice attorneys of

“It would be great if the regulators of hospitals and doctors were more diligent about responding to harm to patients, but they’re not, so people

How An Attorney Can Help You After a Surgical Burn Unfortunately, medical mistakes and their related injuries remain all too common for today’s everyday patient.

The Center for Justice and Democracy (CJ&D), a consumer rights group out of New York Law School, has shared their list of 22 famous figures

The largest ever medical malpractice verdict was awarded on Monday to now-17-year-old Faith DeGrand from Wyandotte, Michigan. After a two week trial and 2.5 hours

An April 10th report by a Goldman Sachs analyst has been making the rounds in the media. The report, entitled “The Genome Revolution,” advised pharmaceutical

The University of Illinois at Chicago and Dr. Nagamani ‘Mani’ Pavuluri, widely considered an expert on bipolar disorder in children, have both been accused of

With the number of sexual assault and harassment claims increasing by the day, the public is beginning to see just how many crimes have been

A well-known downtown Chicago surgical center, Gold Coast Surgicenter, is being sued by a male patient who claims an anesthesiologist negligently administered anesthetic agents, causing him to

A recent study by CNA Financial has found that Nurse Practitioners (NPs) are at the heart of more malpractice lawsuits than in years prior. The

In collaboration with the New York Times, ProPublica authored a multi-part series on the falling cost of generic drugs and insurance. One article sought to

In a collaborative report with Chicago physician Dr. Steven Fox and two pharmacy professors who specialize in drug interactions, the Chicago Tribune has pulled back the curtain

Levin & Perconti has just settled a medical malpractice lawsuit against Mt. Sinai Hospital, recovering $3.6 million for the estate of Alberto Mendez, who died

When we have medical problems we count on the doctor to properly diagnose it and provide us with proper treatment. Unfortunately, sometimes a physician makes

Foot surgery should be considered routine because it is performed every day all across the country with few problems. However, sometimes a mistake is made

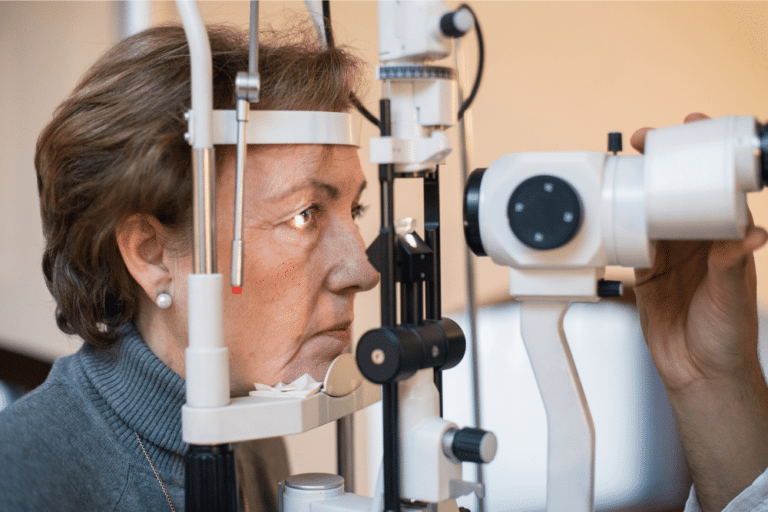

Eye surgery is among the most difficult and delicate types of surgery available. There are a number of reasons why eye surgery may be required.

When we enter the hospital for treatment we trust that the doctors and other medical professionals will provide us with the best care possible. Unfortunately

We trust that when we have surgery the doctor will take all the necessary steps to prevent us from further injury or harm. However, that

A heartbreaking story about a medical error that took the life of a 7-month old baby is being reported at KTLA News. Tressel was the only child for

The use of diagnostic and testing equipment is a necessary part of the diagnosis and treatment of many medical conditions. When we go to a medical facility

When you enter the hospital for routine surgery, you expect that the doctor and medical staff will do everything necessary to keep you from harm.

Those who have good vision often take it for granted. When we visit the eye doctor we trust that the care we receive will help

For those who are balding, a hair transplant could seem like the answer to your dreams. But for one man, the procedure turned into a

When we visit the doctor, we expect that he will properly diagnose the illness and provide the correct treatment. Unfortunately, this was not the case

Vaccinations are usually considered safe for most children. They are necessary for the majority of kids because they can prevent the contraction of some serious

A colonoscopy is typically regarded as a somewhat routine procedure that should be considered safe. This was not the case for one man, who claims

When we enter the hospital for treatment we trust that the doctors and other medical staff will provide us with the best possible care and

Cataract surgery is considered a safe procedure and it is performed thousands of times a day across the country. Yet, sometimes even a routine surgery

Eye care is something that must be taken very seriously. When we have a vision problem we trust that our doctor will properly diagnose and

When we go under the knife we trust that our surgeon and medical team will provide the best possible care during the procedures. That wasn’t

A jury has awarded a family more than $1.1 million dollars in a medical negligence lawsuit. The family of the 84 year old woman was represented

A husband and wife have filed a lawsuit in Cook County against a hospital and doctors. The medical malpractice lawsuit alleges that the man was significantly injured

A joint effort by the Houston Chronicle and ProPublica has shared disturbing news of a former top heart transplant center’s failure rate. In January, the

A lawsuit filed against MetroSouth Medical Center and five doctors has been successfully settled for $4.29 million. The suit was filed on behalf of the

The medical malpractice attorneys won a $1.25 million settlement for a client in a wrongful death case. The deceased in the case went to a hospital in

As reported in the Chicago Daily Law Bulletin, our attorneys at Levin & Perconti have successfully negotiated a $2 million settlement for the family of a thirty-three

So a doctor does not do what he should, breaches standards of care, and a patient is harmed. This is medical malpractice. Whether it is providing

Yesterday we discussed the importance of accurate information on death certificates and the errors that are too commonly made. The AMED News story on the subject explained that

One of the most important pieces of medical documentation used in countless different ways is a death certificate. At first glance, it might be easy

The Watertown Daily Times reported on the filing of a new medical malpractice lawsuit filed by a son following his father’s passing. The 65-year old medical patient died, the lawsuit

Medical records are perhaps the most important piece of evidence in most Illinois medical malpractice cases. A plaintiff in the case is required to show

TC Palm News reported this week on the end of a medical malpractice trial in which a plaintiff-victim was ultimately awarded $257,000. The case involved a broke

Gastric bypass surgery has been growing in popularity in recent years as community members try to take advantage of the new, seemingly positive weight control

Our Chicago medical malpractice attorneys understand that medical errors can often be grouped into two categories. First, there are harms that are caused simply by an

Yesterday our Chicago medical malpractice attorneys Steven M. Levin and Jordan Powell announced that they had reached a settlement in an Illinois medical malpractice lawsuit that had

Most local residents are unaware that the medications that they take each and every day include ingredients that actually play no role in helping patients

An experienced Illinois medical malpractice lawyer understands that each case presents different facts and circumstances that may affect the strategy of a case and its

Chicago malpractice attorneys Steven Levin and Margaret Battersby of Levin & Perconti recently reached a $17.7 million settlement with the University of Illinois at Chicago

The Florida Appeals Court upheld an almost 26 million dollar verdict against a Walgreens Pharmacy after a teenage pharmacy technician improperly filled a prescription and

RUSHVILLE, IL – The community of Rushville, Illinois, is devastated after a collision involving a school bus and a semi-truck killed five people, including three

Nursing home regulations aim to guarantee that residential facilities provide safe, sanitary, home-like environments where residents receive quality care. Inadequate regulation in nursing homes has

The incident at the Judge Fisher Apartments remind us all of the vulnerabilities our cherished seniors face, even in places meant to ensure their safety.

Copyright © 2023, Levin & Perconti